What Is a Charitable Remainder Annuity Trust (CRAT)?

Nov 05, 2023 By Susan Kelly

Introduction

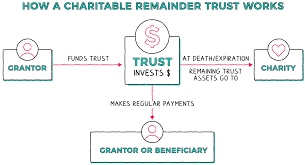

What is a Charitable Remainder Annuity Trust (CRAT)? To avoid the hassle of day-to-day money management and to instead focus on achieving a specific set of financial goals, trusts are used to hold funds or other assets. Also, charitable trusts can provide donors with tax benefits during their lifetime and a residual income stream (RMS) after their death (s). Many forms of charitable giving result in monetary benefits for the giver and their intended recipients. After a CRAT's termination date, any remaining funds are distributed to the beneficiaries chosen causes.

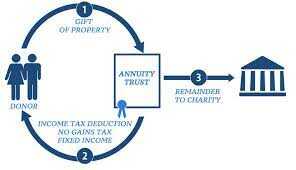

Gifts of money or property can be made to a charitable trust in exchange for the donor or beneficiary receiving an income interest, either permanent or temporary. Noncharitable beneficiaries will receive their share of the trust funds through an annuity, which is determined based on a fixed percentage of the initial value of the trust assets.

How Do I Make a Gift Using a Charitable Remainder Annuity Trust?

By your specific instructions, a trust document is drafted. Your assets will be moved into the trust of your choosing. The trustee usually takes over the assets and invests them in maintaining the annuity payments and preserving the principal. You will receive a set monthly payment for the rest of your life or a set period mutually agreed upon between you and the company. When you pass away or the term ends, any remaining assets will be given to the organization of your choice. Make sure your legal and financial advisors are on board before you get started with gift planning. Your estate and financial plans may change due to establishing a charitable remainder annuity trust.

The IRS index rate, also known as the Applicable Federal Rate, determines whether or not you are eligible for a tax deduction for the income you receive from a charitable trust for remainder annuities and the ages of the donors and income beneficiaries taken into account (AFR). As one matures in years, one can claim a larger standard deduction from their income. The income tax deduction is typically larger if the trust is established for a set period rather than in perpetuity.

The trust is considered an annuity trust with a charitable remainder if the value of the remainder interest is at least 10% of the total value of the assets transferred to the trust. The trust assets used to fund the annuity will also be subjected to a federally mandated 5-percent probability test. The following conditions must be met for a trust provision to be valid: The process of choosing a trustee, naming income beneficiaries, and designating a charitable remainder beneficiary. Choosing the trust's payout rate, setting the payout schedule, and establishing the trust's duration.

Pros and Cons of Crat

The main advantage of a CRAT is the tax savings it provides. In exchange for their contributions to the trust, the trustor can benefit from the lower gift, capital gains, inheritance taxes, and a partial tax credit. Another perk is that, unlike the charitable lead trust, a CRAT allows the trustor or the designated noncharitable beneficiary to receive a regular income stream from the trust while still making charitable contributions. At the time of the trustor's passing, the CRAT will distribute the funds to the beneficiary charity. The trust is safeguarded from predatory relatives and debt collectors.

The biggest problem with CRATs is that the trustor loses all power over the trust's assets because the trust can't be changed. Because of this, changing its rules is extremely difficult, if not impossible. Furthermore, unlike a CRUT, the payment to the beneficiary who is not a charity cannot be increased if the investments of the CRAT do exceptionally well in any given year. A third drawback is that CRATs are complex, which makes them expensive and difficult to build, maintain, and oversee. A cost-benefit analysis should be performed to ensure you are getting the most out of your investment.

What Are a CRAT's Tax Repercussions?

It is a one-time tax break for the grantor determined by the value of the assets initially contributed to the CRAT. Because the CRAT is exempt from taxes and does not collect any when it sells the donated asset, the grantor does not have to pay any capital gains tax when making such a donation. The grantor also enjoys estate and gift tax advantages. However, the beneficiary of a CRAT, not a tax-exempt organization, will be subject to regular income tax on any income generated by the CRAT.

Conclusion

The CRAT is a "split-interest" giving vehicle that allows individuals to achieve their charitable goals while earning income. Along with supporting a chosen charity or charity, the donor may also make general donations. It provides a set amount of money each year to a person other than a charity of the giver's choosing. Once the CRAT's term has ended, any remaining assets will be given to the designated beneficiaries.