Why You Need a Diversified Portfolio

Jan 23, 2024 By Triston Martin

Do you want to ensure your financial security and make wise investments? Are you looking for creative ways to grow your wealth over time? It's important to understand that portfolio diversification is a key component in building a secure financial future.

By understanding asset allocation's role, investors can make informed decisions about how they manage their money. In this blog post, we'll discuss why a diversified portfolio is so important and the benefits of investing in different stock sectors and industries.

We'll also cover strategies for setting up an effective asset allocation plan. Read on to learn more about creating a balanced portfolio.

Why you need a diversified portfolio

A diversified portfolio is an important element of any long-term investment strategy. Investing in various asset classes and types can protect investors from market volatility, downside risk, and the potential for higher returns over time. Diversifying your investments across different asset classes also allows you to benefit from the different performance characteristics of each asset class, which can help to minimize risk while still providing potential growth opportunities.

Without a diversified portfolio, you may be more exposed to the risk of loss should the markets turn downward or one particular sector of the economy suffer an unexpected downturn. You also risk not taking advantage of any gains from different sectors or areas performing well. By diversifying your portfolio, you can spread out your investments across many different asset classes, minimizing the impact of any single investment and allowing for greater opportunities for success in the long run.

A diAd portfolio also allows investors to better manage their risk/reward ratio. By investing in different types of assets with different characteristics, investors can better control the amount of risk they take while still having the potential to make money in the long run. This can help ensure that your investment goals are met responsibly and sustainably.

Why is a diversified portfolio important?

A diversified portfolio is essential for investors looking to protect their wealth and build a secure financial future. Diversification helps to spread investments across different asset classes, minimizing risk and providing the potential for higher returns in the long run. It also allows investors to better manage their risk/reward ratio, as they can control the amount of risk they take while still having the potential to make money.

Diversifying your portfolio can reduce market volatility and downside risk, helping protect you when markets turn downward, or an industry undergoes an unexpected downturn. By taking advantage of the different performance characteristics of each asset class, investors can maximize their chances for long-term success.

Why is it important to have a diversified portfolio

A diversified portfolio is essential for investors looking to protect their wealth and build a secure financial future. A diversified portfolio helps spread investments across different asset classes, minimizing risk while providing the potential for higher returns in the long run. Different types of assets have different characteristics, allowing investors to better manage their risk/reward ratio and control the amount of risk they take.

Diversifying also reduces market volatility and downside risk, protecting an investor’s wealth when markets turn downward, or one sector of the economy suffers a downturn. Investing in a variety of asset classes can help ensure that you are taking advantage of different performance characteristics and maximizing your chances for success in the long term.

Therefore, having a diversified portfolio is an important element of any long-term investment strategy. By creating a well-rounded and balanced portfolio, you can ensure that your financial future is secure while still positioning yourself to make money in the long run.

Why do you need bonds in a diversified portfolio?

Bonds are an important component of any diversified portfolio. Bonds offer a reliable source of predictable income, providing investors with a steady and consistent stream of returns over time. They also tend to be less volatile than stocks and provide additional layer of protection against market downturns. Bonds can also protect your capital by allowing you to purchase them at a discount, meaning you can buy more bonds for less money.

Bonds are typically considered lower-risk investments than stocks and provide an important element of diversification in any portfolio. Investing in different types of bonds with different maturities and yields can reduce their overall risk while still having the potential to make returns in the long run.

Therefore, investing in bonds is an important part of any diversified portfolio and should not be noticed. Bonds can help provide a reliable source of income, protect your capital, and reduce overall risk – all essential elements for a successful long-term investment strategy.

Why do you need stock in a diversified portfolio?

Stocks are an essential part of any diversified portfolio, as they offer the potential for higher returns than other asset classes. Stocks provide greater risk and uncertainty and the possibility of greater rewards. By investing in stocks, investors can benefit from long-term growth and appreciation of their investments and receive dividends that can generate a steady stream of income.

Investing in stocks allows investors to diversify their portfolios and reduce overall risk. Investing in different sectors and industries allows investors to spread their investments so that if one sector or industry suffers a downturn, the other holdings can offset any losses. This helps protect against market volatility, allowing investors to stay invested long-term and benefit from potential growth opportunities.

Investing in stocks is a key part of any diversified portfolio. It offers the potential for higher returns than other asset classes, provides income through dividends, and helps reduce overall risk by providing a greater degree of diversification. With proper research and analysis, stocks can be an important component of any long-term investment strategy.

By taking the time to research and understand the different types of stocks available, investors can create a diversified portfolio that helps protect their wealth while still positioning them for success in the long run.

FAQs

What is a diversified portfolio?

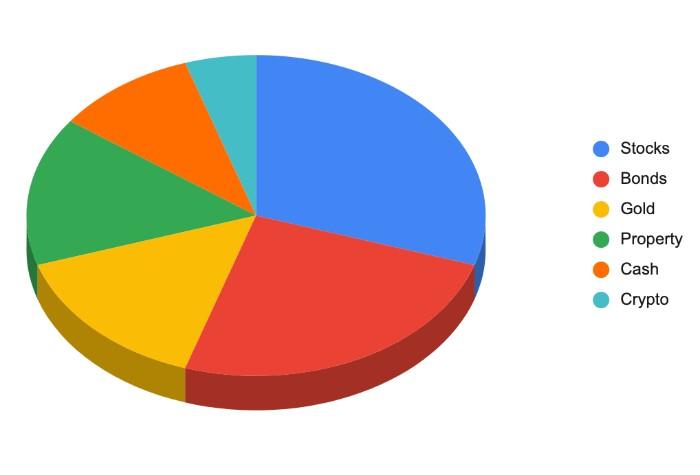

A diversified portfolio is an investment strategy involving investing in various asset classes and securities. This helps to reduce risk by spreading investments across different sectors and industries, reducing the impact of any downturns in one area of the economy. A well-diversified portfolio should include stocks, bonds, mutual funds, real estate, commodities, and

Why do I need a diversified portfolio?

A diversified portfolio is important for long-term success because it helps protect against market volatility and downturns. By investing in different asset classes, investors can reduce the overall risk of their investments and benefit from potential growth opportunities. A diversified portfolio also provides a steady income stream through dividends and bond payments, helping ensure your financial future is secure.

How can I diversify my portfolio?

Investing in various asset classes and securities is the best way to diversify your portfolio. This should include stocks, bonds, mutual funds, real estate, commodities, and cash equivalents. Consider investing in different investments within each asset class to further spread risk. For example, you could invest in large and small-cap stocks, international stocks, bonds of different maturities, or real estate in different locations.

Conclusion

A diversified portfolio is essential to ensure your financial security. Understanding the importance of asset allocation and its role in managing wealth allows you to make smart investments to grow your assets over time. Now that you are armed with this information take a few moments to evaluate your financial situation.